IDFC Club Vistara Credit Card Review

Air Vistara already had launched multiple co-brands cards with Axis Bank, SBI and Indusind but one card that is exemplary among all Vistara cards is the IDFC Club Vistara Credit card.

IDFC Vistara Credit Card is primarily a mid-range card offering and helps give you silver tier of Club Vistara which is midway in the hierarchy with benefits of CV points and premium economy ticket vouchers which are redeemable at Air Vistara flights.

This card is a nice addition to the current set of IDFC First Credit cards and gives another option to regular Vistara travellers.

Table of Contents

Fee and charges

- Annual Fee – ₹4999+GST

- Renewal Fee – ₹4999+GST

Application process

The application process is fairly simple. You need to click on the tab below.

- Need to enter the details and within 2 days, expect the card to be approved

If you are already holding IDFC bank account or another IDFC card, then the approval can happen within 10 mins itself from clicking to approval. Great work has been done by IDFC Bank here.

Annual Benefits

The below benefits are applicable for the users after paying the annual fee

- 1 Complimentary Premium Economy Vistara flight ticket voucher

- Silver Tier Club membership

- 1 complimentary class upgrade voucher

- 1 more additional upgrade voucher from Club Vistara as a silver member.

- 3 month complimentary Eazydiner Prime membership

- 3 month complimentary BQ Prime subscription

Welcome benefit

You need to spend ₹30000 per month for the next 3 months billing cycle post the 1st billing* cycle and get 2000 CV points per cycle.

This means on min ₹90K spends spread over the 3 months, you can receive 6000 CV points which are equal to 1 domestic ticket easily on many routes. (Example – Chandigarh – Mumbai is 5K CV pts, Chandigarh – Bangalore is 6K CV pts)

*This feature post the 1st billing cycle means that if you get the card on 12th June and the billing cycle is 17th June, then you wouldnot have got only 5 days to finish the milestone. This was the initial anomaly at the launch and they rectified immediately upon feedback to give full 30 days to you to finish the milestone.

Earning rate

- 6 CV points on spends upto ₹1Lac in each statement cycle.

- Earn 4 CV points on incremental spends above ₹1Lac

- Earn 10 CV Points on all dining spends on your Birthday

- Earn 1 CV Point on every spend done on Fuel, Insurance, Utility, Rent & Wallet Load. Each CV Point is earned on a spend of ₹200

CV Points are not applicable on EMI Transactions & Cash Withdrawal

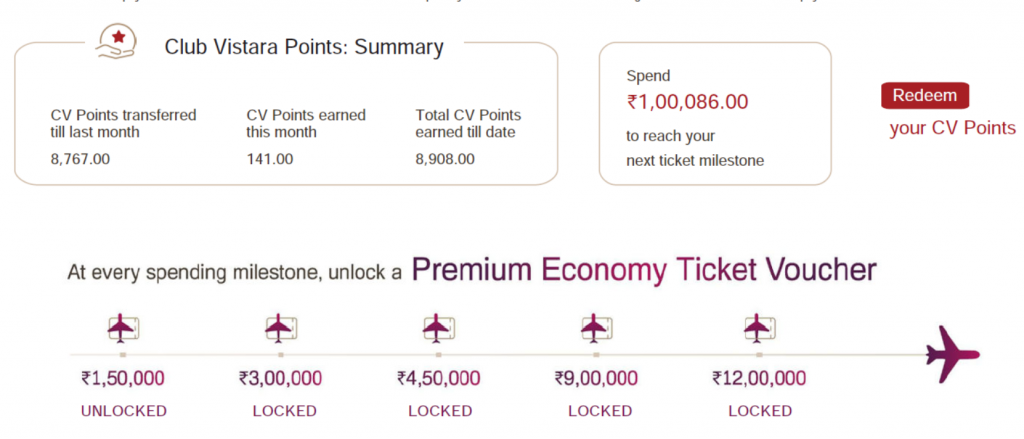

Milestone Benefits

| Spend in a year | Unlock |

| ₹ 1,50,000 | 1st PE Ticket Voucher |

| ₹ 3,00,000 | 2nd PE Ticket Voucher |

| ₹ 4,50,000 | 3rd PE Ticket Voucher |

| ₹ 9,00,000 | 4th PE Ticket Voucher |

| ₹ 12,00,000 | 5th PE Ticket Voucher |

Other Benefits

Lounge Benefits

- 2 complimentary domestic airport lounge and spa access per quarter

- 1 complimentary international airport lounge access per quarter

Pls note that you need to spend minimum ₹ 20000 in prev month to activate lounge access for the next month.

Check out the list of airport lounges and spa you can access powered by Dreamfolks.

Other Key points

- Forex charge – 2.99%+GST

- CFAR (Cancellation For Any Reason) Insurance: You can get a refund of up to ₹ 10,000 on cancelling your flight and hotel bookings made with the card, on 2 cancellations per year.

UPI Option

They have also started offering UPI facility on this card at Rs 199+GST with an offer of Rs 50 cashback on 1st 4 transactions.

You can now activate UPI and get a separate Rupay Card whose spends are added to the main Vistara Card. This means that you can use the Scan and Pay with UPI with merchants and get 1 CV point on Rs 200 spends. This may not seem great but the best part is that it will be linked to the main card and get added to the milestone spends to get the premium economy tickets meaning a reward rate of 4-5% on your UPI spends.

I have earlier used UPI spends on small spends with my Tata Neu card and you can check that review here.

But I intend to switch some spends greater than Rs 200 here to Vistara cards as well.

Club Vistara Silver Membership

The Club Vistara Silver Membership comes with a host of features. I have regularly used these

- 5 KG extra allowance

- Priority Airport Check-in

- 9 CV points/Rs 100 spent on revenue booking

- 1 Complimentary upgrade voucher

1 upgrade vouchers can help in moving one cabin ahead (prem economy to business or economy to Business) on a points or a revenue (Cash) booking.

Redemptions

I typically value 1 CV point = ₹1 since I have been consistently been able to redeem the points at over Rs 1 on my routes.

I typically used on Chandigarh-Bangalore route whose economy tickets are priced above INR 8K

while with CV points, I take it at 6K CV pts+₹1.2K

And a 1 Premium economy voucher, I value at ₹ 7500 since these are in another cabin.

The ticket value also can vary since it gives a free ticket on a direct flight. So, if you use on Delhi-Chandigarh route, then the same ticket will have lower value comparing with Bangalore-Chandigarh route, so lets assume fair value at ₹ 5000

And if you take a connecting flight to Chandigarh to Bangalore via Delhi, then you need 2 vouchers.

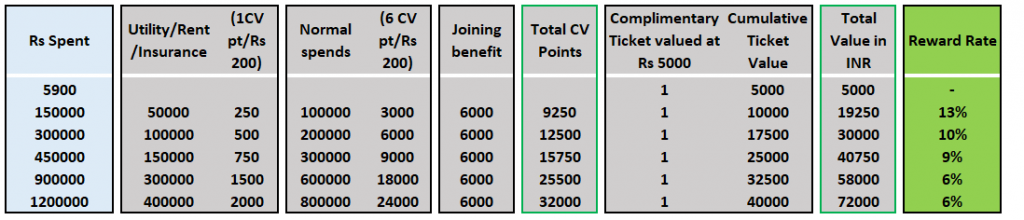

IDFC Vistara Card reward rates

As I mentioned above, the value of points and vouchers can be dynamic depending upon the rate, the best value is at Rs 1.5 Lac spends.

The higher reward rate for 1.5 Lacs is due to the 2 PE tickets you get (1 on joining and 1 on reaching 1.5 Lac spends) but optimal utilization, you can consider ₹4.5Lacs since till that amount for each 1.5 Lacs, we are getting 1 PE ticket voucher.

Why IDFC Vistara Card is better

There is a reason why this card is a class apart from other Vistara co-branded cards. The statement comes with all milestones and how much you need to spend more and where you are on milestone front.

Another important point, the moment you pay the card fees, within a day, I got my status, upgrade vouchers and premium economy voucher. I need to book a ticket and immediately was able to redeem.

Now, as I mentioned above, the UPI addition to the Club Vistara card is another addition which is not available on other Vistara cards.

My Own experience

Now, regarding my own experience with this card and Vistara, I have taken above 40 flights with Air Vistara in last 15 months.

I have flown every month on Domestic flights and also travelled to Thailand and Dubai on Vistara flights in different cabins. The flying experience and hospitability has been great. I also combined 2 upgrade vouchers to get a business class flight.

And, since international flights have higher baggage limit vs Domestic flights, the 5 KG extra cabin baggage allowed me to add economy flight to International flight instead of paying extra charges for baggage.

And also, being a premium member, I have been able to skip check-in lines to save on time.

All in all, I have thoroughly enjoyed Vistara services.

Upcoming Air India merger

There was an announcement for Air India and Vistara already and few details are emerging and effective date is not announced but few things are already clear or expected

- Existing Vistara upgrades expect be moved to Air India (You may expect an upgrade basis cumulative spends)

- The existing bookings will be moved to Air India

- The Vouchers will be moved to Air India with existing validities

- The Points will be transferred in 1:1 ratio

Although it may take some time for Air India service standards to improve to Vistara levels and we may see some value reduction on some routes but the positive is that it will open a lot more options to fly since Air India flies on many routes compared to Vistara. I will still recommend having this card.

If you liked this post, then please do share and comment. You can also follow me on my twitter (X) handle www.twitter.com/bachatxpert

Keep reading and please keep sharing…. More Bachat on the way!!!!

Great thread, what about government spends?

U get 1 CV points for Rs 200 spent on govt spends but the best part is that the government spends are added to your milestone for getting the premium economy tickets.

Wallet load for milestone benefits?

Yes, you can do the same. 1 Reward point/Rs 200 but adds to the milestone